Where Should You Die? (From a Tax Perspective, Of Course)

- Tom Turnbull

- Nov 24, 2025

- 3 min read

here’s a saying that I heard from a CPA. There are dad jokes. This is a CPA joke:

“Make your money in Washington because there’s no income tax. Spend your money in Oregon because there’s no sales tax. And die in California because there’s no estate tax.”

From a pure tax standpoint, California always wins the West Coast battle when it comes to where to die — because it has no state estate or inheritance tax at all.

But of course, most people don’t pick where they live (and eventually pass) purely based on tax policy. That would be weird. You have family. You have community. You have meaning attached to a place. For me, the potential tax savings of living in certain other states — I won’t name names — simply isn’t worth the tradeoff in quality of life.

That said, here in the Portland, Oregon – Vancouver, Washington metro area, the question of “where to die” is not just academic.

It’s only a bridge crossing away, so to speak.

And more and more, I’m watching people actually make the move to Washington — due in large part to Oregon taxes, and in particular, Multnomah County taxes.

Which raises an important planning question:

If taxes were the only consideration, should you “die” in Oregon or Washington?

Most people would assume the answer is Washington. But…not so fast.

Oregon vs. Washington: The Big Difference

Here’s the key contrast:

Oregon’s estate tax exemption: $1,000,000

Washington’s estate tax exemption: $3,000,000

That alone makes Washington look dramatically more attractive. But this is only half of the story.

Washington’s estate tax rates climb much higher than Oregon’s at larger estate sizes.

So the real answer to “Where is it better to die?” is:

It depends entirely on the size of your estate.

To explore this more precisely, I built a model that compares Oregon and Washington estate taxes side-by-side at different estate values.

Real World Examples (Side-by-Side)

Here’s what the math shows:

Estate Value | Oregon Estate Tax | Washington Estate Tax | Winner |

$2,000,000 | $101,250 | $0 | Washington |

$5,000,000 | $425,000 | $250,000 | Washington |

$7,000,000 | $667,500 | $610,000 | Washington (slightly) |

$8,000,000 | $802,500 | $840,000 | Oregon (slightly) |

$10,000,000 | $1,102,500 | $1,330,000 | Oregon |

$20,000,000 | $2,702,500 | $4,730,000 | Oregon |

There is a very specific point where things flip.

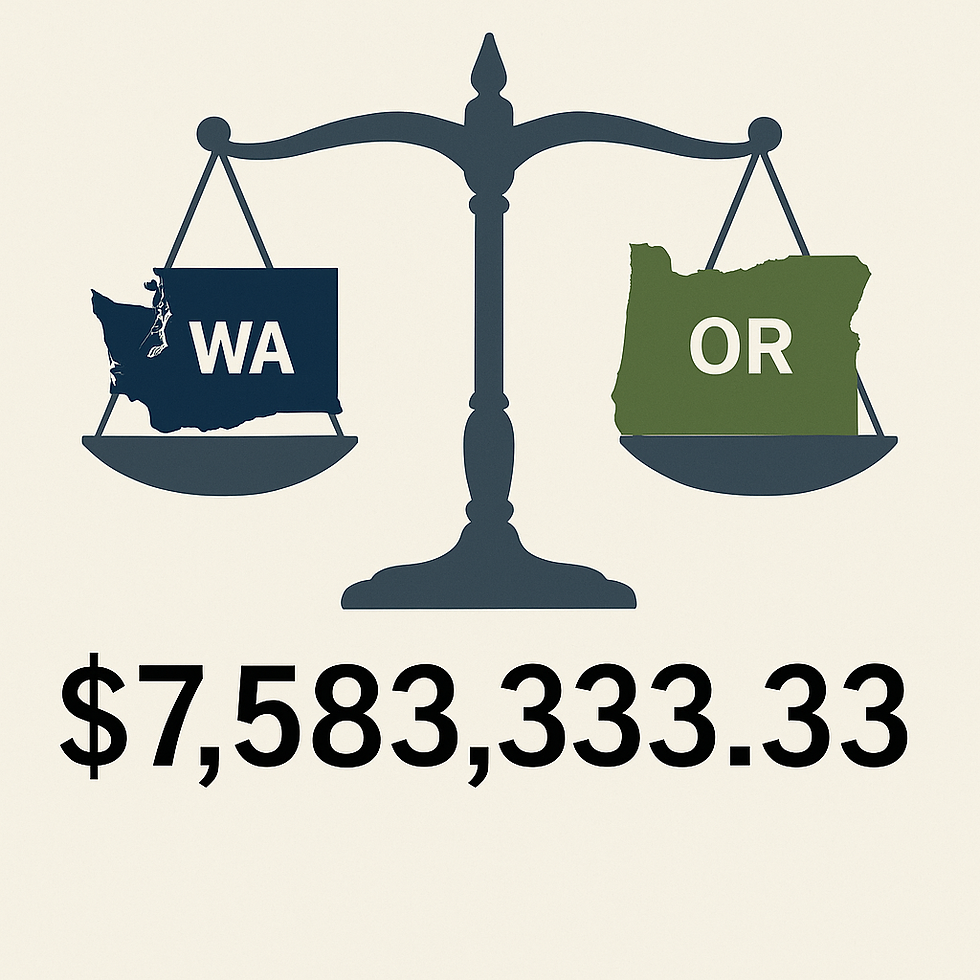

The Exact Break-Even Point

The precise estate value at which Oregon and Washington estate tax are exactly equal is: $7,583,333.33

Below $7.58M → Washington is the better state to die in (tax-wise)

Above $7.58M → Oregon becomes the better state to die in (tax-wise)

That number will make an appearance in my personal estate-planning trivia hall of fame.

What About Federal Estate Tax?

Federal estate tax currently does not kick in until an estate exceeds $15M million (starting in 2026).

Above that number, every additional dollar is effectively taxed at 40% federally, regardless of whether you die in Oregon or Washington.

So:

Below ~$15M → State taxes make up the majority of the planning discussion

Above ~$54M → Federal tax becomes a huge factor

This is also included in the calculator.

Try it Yourself – The “Where To Die Calculator”

I’ve built a simple, locked-down Google Sheet where you can input an estate value and see:

Oregon estate tax

Washington estate tax

Federal estate tax (if applicable)

Total results side-by-side

You can play with it here: Link to The “Where To Die Calculator”

I’ve locked the formulas, so the only thing you can edit is the estate value cell.

Also, don’t take the name too seriously.

The Bottom Line

The lesson isn’t: “Move to Washington”And it’s not: “Stay in Oregon.”

The lesson is this:

Location matters. Size matters. And smart planning matters even more.

Your home, your family, your business, and your life should always drive the decision first.

Then we optimize for taxes — not the other way around.

Comments